News

Categories

April is Financial Literacy Month! For the Council for Economic Education, Financial Literacy Month is a meaningful moment to share the work we do. But why should the...

The Council for Economic Education’s Latest Survey of the States Finds 35 States Now Require Personal Finance Courses and 28 Mandate Economics for Graduation.

Teaching personal finance to high school students comes with plenty of challenges. "I find it difficult because kids are...

The responses we received were inspiring! These students care deeply about their communities. They discussed the environment, inflation, housing shortages, ways to support local businesses, and much more....

In celebration of Economic Education Month this October, CEE is inviting students nationwide to participate in our econ student video contest! This contest offers K-12 students the chance...

With the nation’s leaders deeply divided over the federal budget and financial uncertainty facing families across America, high school students from coast to coast during October’s Economic Education...

Council for Economic Education is pleased to announce the release of their 5th Edition of AP Economics Macro and Micro Teacher and Student Editions. These CEE bestsellers feature...

CEE is a leader in defining national standards for the teaching of K-12 personal finance, outlining what students should know by grade level. Our latest National Standards for...

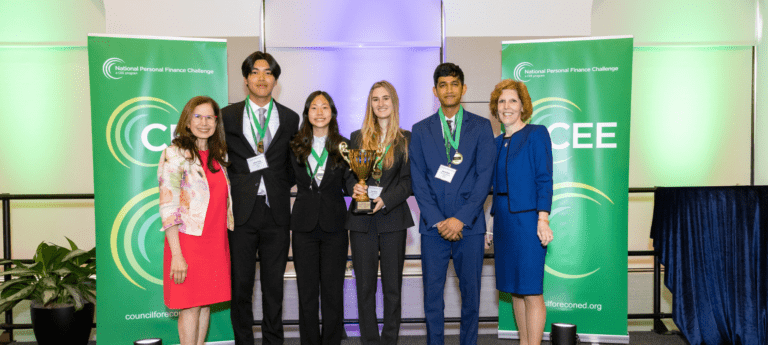

The results are in and students From California, Alabama, Arkansas and Kansas have been named top in the U.S.A. in CEE’s National Personal Finance Challenge! The National Personal...

CEE is delighted to share that the American Fair Credit Council (AFCC) and their member companies have contributed $75,000 to CEE to help us in our mission to...

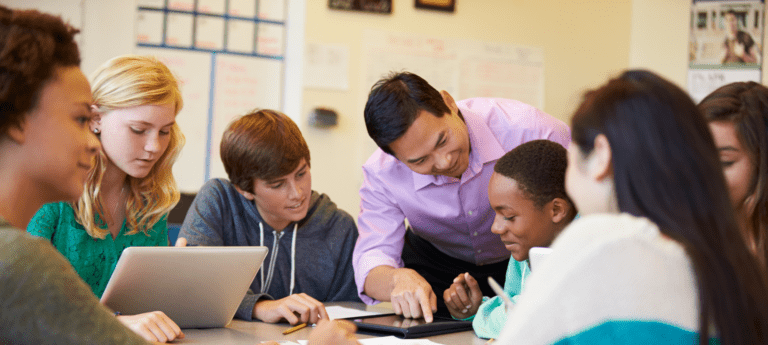

CEE’s mission is to equip K-12 students with the tools and knowledge of personal finance and economics so that they can make better decisions for themselves, their families,...

Congratulations to the finalists for the 2023 National Economics Challenge! The National Economics Challenge (NEC) is the country’s only economics competition of its kind for high school students....