RESEARCH

Recent Research on Economic and Financial Literacy

CEE is pleased to present a selection of empirical research and peer-reviewed studies that demonstrate that students exposed to economic and financial education are more likely to display positive economic and financial behaviors.

June 2022

Does State-Mandated Financial Education Reduce High School Graduation Rates?

This paper evaluates the impact personal finance graduation requirements has on graduation rates. They investigate whether these requirements act as an additional barrier for students. There is no evidence that these requirements impact overall graduation rates. Nor do they impact graduation rates by race, gender or family income.

Authors: Carly Urban

March 2022

CFPB 2021 Financial Literacy Annual Report

This report details CFPB’s financial literacy strategy and activities to improve financial literacy of consumers. It outlines the impact financial literacy can have on underserved communities, students, service members, and older adults. The report confirms that literacy levels vary significantly across demographic groups and impact the consumer’s ability to make sound financial decisions. Based on the report, there are five principles of effective financial education: 1. Know the Individuals and Families to be Served 2. Provide Actionable, Relevant, and Timely Information 3. Improve Key Financial Skills 4. Build on Motivation 5. Make it Easy to Make Good Decisions and Follow through. There is a section focused on identifying the needs of each community and how financial education must be crafted around that.

Authors: Consumer Financial Protection Bureau

April 2022

The TIAA Institute-Gflec Personal Finance Index

The P-Fin Index is an annual survey developed by the TIAA Institute and the Global Financial Literacy Excellence Center, in consultation with Greenwald & Associates, to assess how financial literacy varies among U.S. adults.

Authors: Paul J. Yakoboski, Annamaria Lusardi, Andrea Hasler

April 2022

Economic Attitudes and Attitude Change: The Impact of Economic Instruction in Early Adolescence

The authors focus on the cognitive changes that occur when an early economic education is a part of early adolescence curriculum. The study focuses on 9th graders and how group un-exposed to the economic instruction’s attitudes differed from the student who had received an economic education. Ultimately the study found that economic instruction did have an impact on student’s attitudes towards the economy.

Authors: Steven J. Ingels, Mary Utne O’Brien

August 2022

The Meta-Analysis of Financial Education Programs

Ten years in the making, with data from 22 countries, and based on the results of 76 randomized experiments, this meta-analysis of how financial education affects financial knowledge and downstream behaviors demonstrates the importance of our work.

Authors: Tim Kaiser, Annamaria Lusardi, Lukas Menkhoff, Carly Urban

April 2022

Global Financial Literacy Survey

Standards & Poor’s Ratings Services tested individuals’ knowledge of four basic financial concepts: numeracy, interest compounding, inflation, and risk diversification in a survey of 150,000 adults in 148 target countries.

Authors: Leora Klapper, Annamaria Lusardi, Peter van Oudheusden

February 2022

Does Financial Education in High School Affect Retirement Savings in Adulthood?

This paper investigates the impact a financial education in high school can have on retirement savings in adulthood. Findings don’t offer a definitive relationship between retirement savings and economic education. Because of this, it is recommended to focus economic education on content that is more immediately relevant for 18-year-olds, such as budgeting, long-term debt, and credit.

Authors: Melody Harvey, Carly Urban

November 2021

Empowering Women in Finance through Developing Girls’ Financial Literacy Skills in the United States

The Boston University Wheelock College of Education and Human Development sought to assess the program efficacy of Invest in Girls (IIG) and investigate the perspectives of the female students on its impact on their knowledge, behavior, and future goals and aspirations. The results indicate that IIG participants have significantly higher confidence in engaging in financing literacy and more likely to consider wide occupational pathways available in finance.

Authors: Chong Myung Park, Aidan D. Kraus, Yanling Dai, Crystal Fantry, Turner Block, Betsy Kelder, Kimberly A. S. Howard, V. Scott H. Solberg

September 2021

Financial Anxiety and Stress Among U.S. Adults: New Evidence From a National Survey and Focus Groups

This study evaluates the levels of financial stress in U.S. adults, and what the contributing factors are to that stress. They identify that the financial situation, knowledge of money management, and the access to financial literacy are key indicators of stress. Access to financial education courses is mentioned as a solution to some of these key stress factors.

Authors: Andrea Hasler, Annamaria Lusardi, Olivia Valdes

August 2021

Financial literacy in the United States

This paper paints a worrisome picture of the financial literacy landscape in the U.S. The empirical evidence suggests that many individuals in the US—both young and old—lack the basic knowledge and skills required to engage in sound financial decision-making, a situation that significantly threatens their prosperity and financial well-being. At the same time, the results indicate that financial literacy varies substantially across sociodemographic groups—more than in other similarly developed countries. We identify clear and persistent gaps in financial literacy along racial, socioeconomic, and gender lines, which, if unattended to, are likely to amplify existing inequalities across the population.

Authors: Oscar Contreras, PhD AND Joseph Bendix

March 2021

How Confident are Potential Personal Finance Teachers?

In this study they examine current standings in teacher confidence, training take up, and dispositions toward person finance requirements. Since 2009, they find that confidence in teaching personal finance among teachers has increased from 9% to 70%. This increase could be due to the number of states requiring instruction having doubled since 2009. Confidence in financial literacy instruction correlates with the rise in professional development opportunities that have become available.

Authors: Carly Urban & Melody Harvey

October 2020

Experiential Financial Education: A Field Study of my Classroom Economy in Elementary Schools

This is a field study on simulated economy in an elementary level classroom. The Classroom Economy provides financial literacy instruction without requiring significant classroom time and is relatively simple for teachers to implement. Students that had access to these classrooms showed improvements in financial knowledge as compared to classrooms who didn’t implement the Classroom Economy. Experiential financial education appears to be an effective strategy to teach financial literacy, even at lower grade levels. It is also a relatively low-cost approach that does not require extensive teacher preparation. The integration of this model may make teachers more willing to eventually introduce a formal economics course.

Authors: Michael Batty, J. Michael Collins, Collin O’Rourke, Elizabeth Odders-White

October 2020

The Effects of High School Personal Financial Education Policies on Financial Behavior

The authors investigate the impact that a complete financial education (prior to graduation) has on credit report outcomes for young adults between the ages of 18 and 21. The findings suggest that having a complete financial education led to fewer defaults and higher credit scores among young adults. These findings highlight the importance of heterogeneity at the state level and concludes that well-funded teacher preparation may be the key to implementing a successful program.

Authors: Carly Urban, Maximilian Schmeiser, J. Michael Collins, Alexandra Brown

April 2020

Using K–12 Schools to Promote Civic Engagement through Economic Literacy

The author examines the role that schools play in establishing the essential principles of democratic life and civic involvement, as well as financial literacy. Key findings indicate that K-12 educators should prepare students to engage with a host of macro- and microeconomic dilemmas and questions that promote active and engaged democratic citizenship.

Authors: Anand R. Marri

March 2020

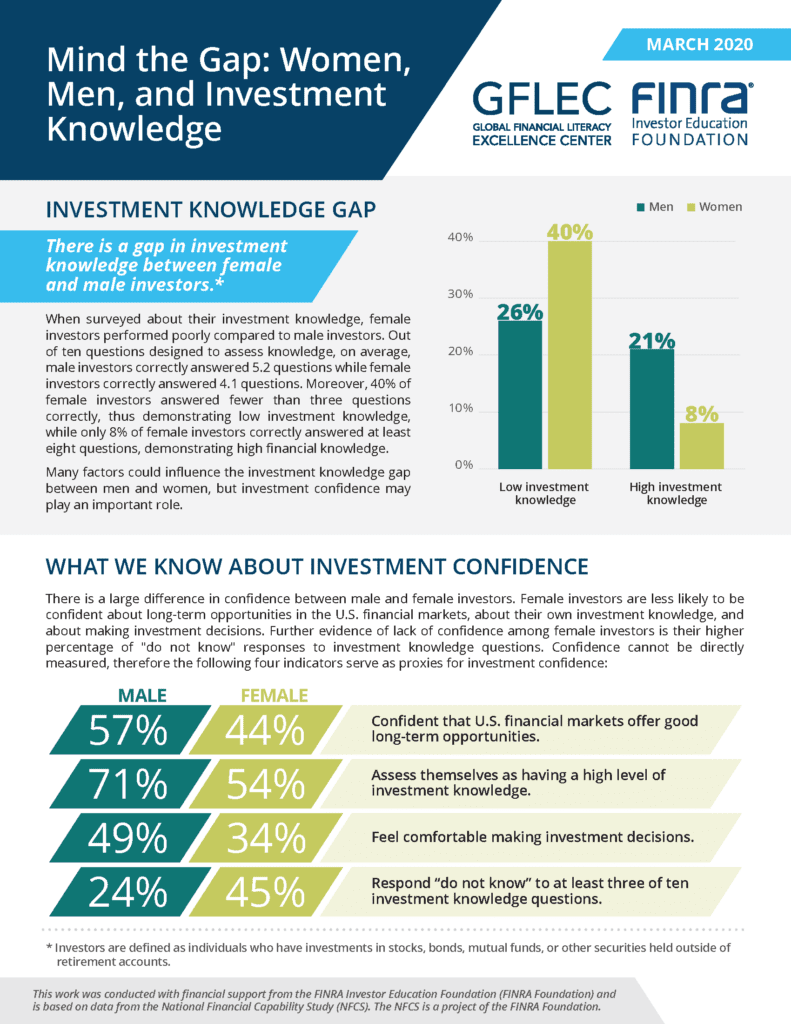

Mind the Gap: Women, Men, and Investment Knowledge

GFLEC & FINRA sought to investigate the differences between investment knowledge among men and women. One of the key findings indicate that confidence in decision making is a major factor to how well women scored on their investment knowledge.

Authors: FINRA & GFLEC

June 2019

Managing Personal Finance Literacy in the United States: A Case Study

Authors investigate the impact of personal finance education in Western Pennsylvania. Findings indicate that in grades K-8, the curriculum should be tied to math courses to help youth learn personal finance concepts early alongside concepts they are already learning. Whereas stand-alone courses should be offered at the 9-12 grade levels. These findings were collected through interviews with teachers and parents.

Authors: Joshua J. Beck and Richard O. Garris III

May 2019

The Effects of State-Mandated Financial Education on College Financing Behaviors

This study measures the impact of high school personal finance graduation requirements on financial aid decisions made by students entering a 4-year college. Findings suggest that more financial education leads students to access lower-cost financing by increasing aid applications and acceptance and decreasing the likelihood of students holding credit card balances.

Authors: Christiana Stoddard, Carly Urban

April 2018

Financial education among financially vulnerable populations in the United States

This article examines state-mandated financial education and whether it improves debt-related and college-going behaviors (payday borrowing and sub-optimally financing post-secondary education) among economically vulnerable young adults. Findings suggest that exposure to personal finance course requirements reduces engaging in adverse behaviors.

Authors: Melody Harvey

March 2018

Gender, Generation and Financial Knowledge: A Six-Year Perspective

This FINRA study examines financial knowledge levels among different genders and generations and indicates the impact a lack of knowledge can have on women financial future. Over a six-year period, women routinely trail men in financial knowledge within their generation and men generally have more access to these financial education programs.

Authors: Gary Mottola, Ph.D.

November 2016

Student Loan Debt in the US: An Analysis of the 2015 NFCS Data

With data from the FINRA Investor Education Foundation’s 2015 National Financial Capability Study (NFCS), the George Washington University School of Business, Global Financial Literacy Excellence Center sought to examine the impact of student loan debt on individuals and on the economy writ large.

Authors: Annamaria Lusardi, Carlo de Bassa Scheresberg, Noemi Oggero

July 2016

Financial Capability in the United States 2016

The FINRA Investor Education Foundation published an assessment of the financial capabilities of American adults, in terms of their ability to make ends meet, plan ahead, effectively manage financial products, and their level of financial literacy.

Authors: Judy T. Lin, Christopher Bumcrot, Tippy Ulicny, Annamaria Lusardi, Gary Mottola, Gerri Walsh, Christine Kieffer

March 2016

Youth Financial Literacy in the United States: A Patchwork Approach

The results from a FINRA survey (as of 2016) indicate that despite overall gains in financial well-being in the US, the general population is struggling with to meet financial obligations (retirement savings & debt management). Heath examines the lack of consistent financial education requirements across the country and how it impacts financial literacy, suggesting that obtaining financial education outside of K-12 is more difficult to conceptualize and less accessible for many groups (non-college educated; low income; etc).

Authors: Julia A. Heath

January 2015

State Financial Education Mandates

To measure the positive effects of state-mandated financial education on the credit behavior of young adults, the authors compared credit scores and delinquency rates of young adults both before and after financial literacy mandates were instituted.

Authors: Carly Urban, Maximilian Schmeiser, J. Michael Collins, Alexandra Brown

January 2015

How College Students Behave Financially and Plan for the Future

Seeking to understand the factors that most influence financial capability and how to best support the next generation of adults in achieving their financial goals, investigators surveyed 42,000 college students from across the country to assess their financial behaviors and preparation for adulthood.

Contact our Program Team to learn more about sponsoring or collaborating on research with CEE.